Are charm prices, percentage discounts, and complex promotions actually working anymore? For a growing number of US consumers, the answer is no. In a landscape where shoppers are more budget-conscious, digitally savvy, and emotionally attuned than ever, the old pricing playbook is falling short.

Our latest Pricing Report, based on nationally representative responses, reveals that what shoppers really want isn’t just the lowest price. It’s clarity, fairness, and value that feels real. Retailers and brands still have room to move, but only if they rethink how pricing is presented, not just where it lands on the shelf.

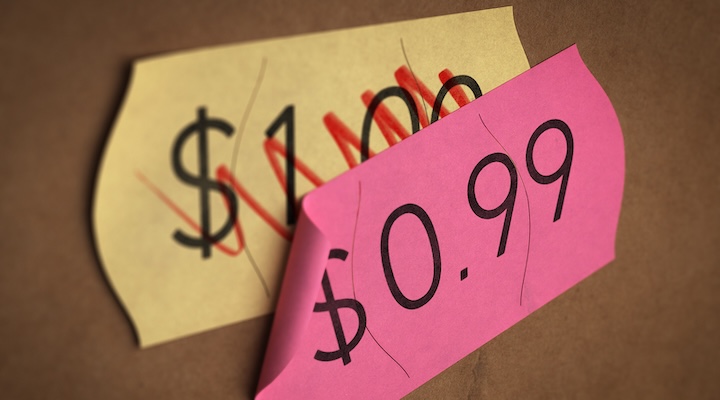

Pricing is being judged by clarity, not tricks

When asked how they assess whether a product is good value, 39 per cent of shoppers said they look at the total price first, with only 4 per cent mentioning price endings. Despite decades of retail convention, psychological pricing cues like $1.99 are no longer persuasive on their own.

That’s not to say charm pricing is irrelevant, but its influence is now category dependent. In our behavioral pricing tests, $0.99 pasta received 88 per cent purchase intent, compared to 83 per cent for $1.00 and 67 per cent for $0.95. For bread, however, pricing changes barely shifted purchase intent, and in some categories, rounding up was seen as more transparent.

Round numbers feel more honest

Consumer feedback highlighted a strong emotional response to price formatting. Many shoppers described round prices as more “honest,” “easier to understand,” or simply more respectful. One respondent commented, “I round up anyway, so just show me the real price.”

This kind of sentiment matters. In an environment where pricing can change week to week, price transparency isn’t just a tactical win; it’s a trust-builder.

Promotions are more effective when they reduce friction

Our research also found that straightforward promotions beat complex ones. Shoppers said they preferred offers like “Buy one, get one free” or flat dollar discounts over percentages or layered deals. Meal bundles for families were popular, as were mix-and-match offers for smaller households.

Shoppers also showed positive sentiment toward loyalty programs – when they delivered real savings. Fuel rewards, digital coupons, and free delivery all received praise. On the other hand, promotions that required calculations or exclusive access received backlash.

One consumer summed it up: “If I have to work to get the discount, it’s not a discount.”

Price perception is emotional and household-specific

Ultimately, our findings show that price perception is influenced as much by emotion as by economics. Smaller households often feel excluded by bulk discounts, while larger households lean into them. Some shoppers view everyday low pricing models as more fair, while others appreciate the control that comes with loyalty-linked offers.

What unites them is a desire for clarity. Pricing that feels predictable, fair, and tailored to their needs is more likely to drive conversion and loyalty.

What this means for you

Retailers and brands can act on these insights by rethinking how price is framed, not just set. Clarity around total price should take precedence over fractional cues, and charm pricing should only be used where category norms support it. Promotions should be designed to feel effortless, particularly for time-pressed households, and offers should be flexible enough to serve different shopping missions and household sizes. Loyalty programs, meanwhile, need to focus on utility over complexity. In today’s market, simplicity is not a compromise; it’s a competitive advantage.