As US consumer shopping patterns change – dramatically in some categories – retailers need to be more nimble to recognise the trends and react to them. If they don’t, warns one expert analyst, they risk losing sales to rivals.

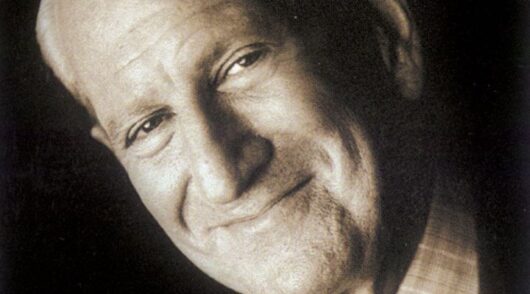

RJ Hottovy, head of analytical research at Placer.ai, talked through some of the evolution in retail in the post-pandemic era with Inside Retail’s Amie Larter in an episode of the podcast Retail Untangled, recorded on the sidelines of Shoptalk Fall in Chicago.

“There is no new normal,” Hottovy told Larter. “Year after year, we keep seeing some other disruption, another major shift in behavior or another macro trend that impacts consumers.

“We are in an environment where you have to move fast. You have to be willing to take some risks. But ultimately, at the same time, there are a lot of data sources, like Placer.ai and others, that can help you out in terms of new real estate decisions and how the calculus behind new stores has completely changed.”

The battle for grocery spend

Hottovy says that out of all retail categories in the US, the most significant change in consumer behavior is now evident in the grocery category. After the major migration online during lockdowns and social distancing, consumers started to move back to physical store visits as inconvenient pickup windows and delivery fees, for example, dulled the enthusiasm for buying groceries online.

Then, in 2022-2023, rising inflation – particularly in the food-at-home category – began influencing consumers’ grocery purchases. Placer.ai’s data shows that many US consumers retrained themselves on filling their shopping basket last year. They are not necessarily buying more products; they are shopping around more locations to find them.

“So last year, they were going to Aldi for the first time, or maybe Trader Joe’s. They were rediscovering grocery outlet stores. This year, they’ve solidified that routine. Maybe they’re going to their traditional grocery store for certain things, a discount grocer for other things, maybe a good dollar store for other things, and maybe convenience stores.”

He says that has resulted in the average spend per visit falling, with consumers buying fewer units per transaction. It has become more challenging for retailers to break into their new shopping routines.

“They know what they want and spend less time in the store. We’ve seen dwell time come down … and consumers are now very deal-driven.”

Superstores are drawing increased visits, and Hottovy cites the genre as “a good example for grocers to follow” in cracking that audience.

“We started to see the rollbacks from Walmart and Target and Costco, generally pushing back on its vendors and keeping pricing where it needed to be – and all of a sudden, we started to see them start to claw back some of the visitation share they had lost to Aldi and others during the past year. I think the superstores have really proved to be a pretty good model on that front.”

Dollar stores have reached saturation point

While superstores have been disruptive to many other categories, dollar stores have “had a moment in the sun” as well – especially during Covid and through to early this year. “However, perhaps they’ve reached the point of saturation,” says Hottovy. “On a comparable visit trend, we’re seeing things go negative year-over-year.”

Trade is still up thanks to the sheer number of dollar stores that have opened, but Hottovy sees the sector becoming a lot more competitive.

“Low prices aren’t everything. There has been underinvestment in some of these dollar stores and discount stores, which probably needs to be addressed by some retailers.”

He singles out drugstores as another category that has been “severely disrupted” during the past couple of years. “A lot of these chains probably over-expand and had too many locations in certain markets.”

He says that as drugstores are trimming back their network, some of their past customers are migrating not to other stores under the same banner but to alternative destinations with pharmacies, like superstores, grocers and even warehouse clubs.

Beauty’s stellar growth is slowing

Hottovy sees beauty struggling after a strong 2022-23 period when people re-emerged from lockdowns and started going out in public and socialising again. Beauty retailers noted many more visits in that peak era, especially among younger consumers.

Now, apparel is experiencing a similar upturn trend, spurred partly by people returning to work in offices who want to update their wardrobes.

“If you look at apparel overall, it is probably flat to slightly down, but the retailers selling more unique, differentiated apparel stand out. Anthropology or Free People, for example, allow customers to build their own identity with apparel. Winners and losers are starting to emerge in apparel, and the more idiosyncratic retailers are jumping out right now.”

Beauty has experienced a lot of growth and disruption, says Hottovy. “Two players have emerged: Sephora and Ulta Beauty. Both have introduced new amenities and services within their stores and boosted partner stores’ turnover, like Target and Kohl’s.

“That’s been very powerful. It shows that it’s not just the product; it has to be the experience. And I think they’ve also done a tremendous job.”

Another change in the beauty sector is the trend away from cities to meet consumers where they are – in suburban and rural markets.

He adds that Ulta has done a fantastic job bringing more diversity to its product mix, which has drawn a more diverse visitor base. “They are a perfect example of how if you want to diversify your customer base, it starts with the product. It’s amazing to see the traders shift … and going after more of the African American and Latino populations.”

- Listen to the Retail Untangled podcast for more category insights as Larter and Hottovy unpack trending consumer behavior in the post-Covid era.