Pharmacy chain Rite Aid has received interim approval from the court to access up to $3.45 billion in debtor-in-possession financing after it filed for Chapter 11 bankruptcy protection last week.

The financing, which is from certain of its lenders, is expected to provide sufficient liquidity to support the company throughout the Chapter 11 process.

The court also authorized the firm to continue paying its employees, vendors and suppliers, as well as delivering healthcare products and services.

“We are pleased to have received court approval of these critical First Day motions, which will enable Rite Aid to continue serving our customers and meeting their pharmacy needs throughout this process.

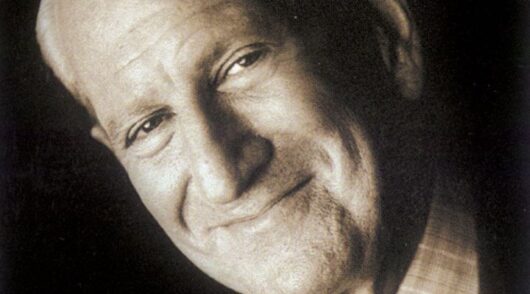

“With the support of certain of our lenders and the majority of our bondholders, we look forward to moving through this process and emerging as a stronger company, well-positioned for long-term success,” said Jeffrey S Stein, CEO and chief restructuring officer of Rite Aid.

As of June, Rite Aid had $3.3 billion in debt, while its stock has fallen nearly 80 per cent since the start of the year. The company has been facing lawsuits alleging they helped fuel the opioid crisis in the US.

The chain, which operates over 2100 retail pharmacy locations across 17 states, said it would close additional underperforming stores to further reduce rent expenses.