Salvatore Ferragamo’s CEO promised a quick turnaround for the Italian luxury group, vowing to increase investments, revamp stores and attract younger customers to double revenues to almost 2.3 billion euros by 2026.

Marco Gobbetti, who joined the family-owned group in January from Burberry, forecast a rise in Ferragamo’s sales this year despite problems in China, where retail revenues declined in the first quarter due to new Covid-19 restrictions.

Gobbetti said that disruptions in China, which began at the end of March, had worsened in April. But he said a strong performance in the United States and Europe had helped Ferragamo to reduce its dependency on the Chinese market, where it made 30 per cent of its sales last year.

Outlining his strategy, Gobbetti said the group aimed to double the marketing and communication spending share of total revenues from 2023, and targeted 400 million euros in investments in 2023-26, focusing on store renovations, technology and supply chain.

“This is not a plan where we work 2-3 years before we see results,” Gobbetti told analysts.

“One of the key elements of this plan is speed… We want to go quickly,” he said.

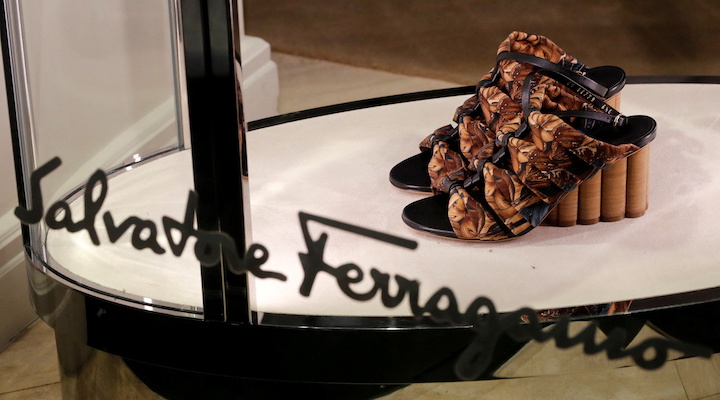

The leather goods maker, famous for making shoes for Hollywood stars such as Audrey Hepburn, has been underperforming rivals due to lower investments, low online penetration and a product offer perceived as old-fashioned, in addition to a high exposure to travel spending particularly hit by the pandemic.

But the group managed to beat market expectations in the first quarter, with overall sales rising by 21 per cent at constant exchange rates to 289 million euros (US$304.72 million) – above an analyst average estimate of 273 million euros.

Operating profit totalled 24 million euros from 7 million euros a year earlier.

The second quarter is likely to be more difficult as China’s zero-Covid policy, with heavy restrictions in place in the luxury hub of Shanghai and other cities, looms large over the luxury industry.

Around 50% of luxury stores are currently closed or operating with reduced traffic in China, which is fast becoming the world’s most important market for high-end goods, according to a Barclays report.

Analysts say sales in the country could fall by 30 to 50 per cent in the three months to end-June.

Worries that the curbs in China could last longer than initially hoped for have triggered a sell-off in luxury stocks, with Tuscany-based Ferragamo among the hardest hit.

Its shares have fallen 40 per cent since the start of the year, compared with a 24% decline for industry leader LVMH, and shed more than 7% before the results on Tuesday.

That has helped rekindle rumours of a possible takeover, which the Ferragamo family categorically denied on Monday. The announcement that Gobbetti would join as CEO had already dampened M&A speculation at the end of last year.

- Reporting by Claudia Cristoferi, editing by Silvia Aloisi and Jane Merriman, of Reuters.