Beyond Inc has signed a strategic partnership with home furnishings retailer Kirkland’s to bring back physical stores under the Bed Bath & Beyond brand.

As part of the agreement, Kirkland’s will become the exclusive brick-and-mortar operator and licensee for smaller format ‘neighborhood’ Bed Bath & Beyond locations nationwide. Kirkland’s currently operates 325 stores in 35 states.

Beyond, in return, will invest $25 million via combined debt and equity transaction to strengthen Kirkland’s capital position and fuel its growth initiatives. This includes a $17 million term loan credit agreement and an $8 million purchase of Kirkland’s common stock.

Kirkland’s will use the proceeds from the term loan portion to repay its existing term loan with Gordon Brothers. Following the closing of the common stock purchase, Beyond will have a right to nominate two independent directors to Kirkland’s board.

The companies will share their consumer data, global loyalty program, financial services, and consumer protection products. They will also work to reduce costs, improve inventory management, and drive revenue growth.

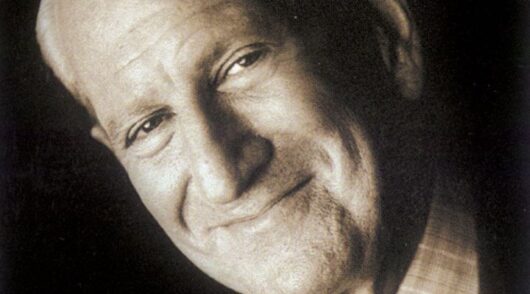

“An omnichannel approach to Bed Bath & Beyond is quintessential to its success,” said Marcus Lemonis, executive chairman of Beyond.

“We view this partnership as a meaningful step forward in our long-term vision of growing through asset-light collaboration with complementary businesses while monetizing both the intellectual property of our iconic brands as well as the suite of affinity products being developed,” Lemonis added.

Midvale, Utah-based Beyond is the parent company of Overstock, Bed Bath & Beyond, Baby & Beyond, Zulily. The firm filed for Chapter 11 bankruptcy early last year and later closed all physical stores of the Bed Bath & Beyond banner.

Last week, the company announced its $40 million investment in The Container Store through an equity transaction.