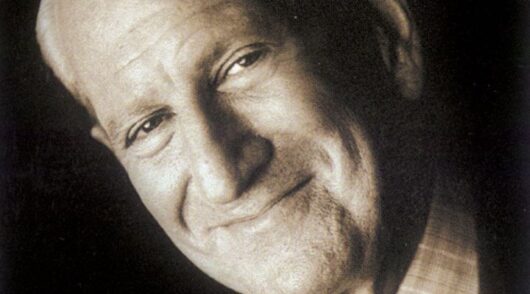

CVS Health has appointed David Joyner as president and CEO – succeeding Karen Lynch, who stepped down from the role – as investors seek to see improvement in the company.

Joyner has 37 years of experience in health care and pharmacy benefit management, most recently as EVP of CVS Health and president of CVS Caremark.

CVS Health announced the appointment, effective October 17, while withdrawing its full-year earnings forecast and providing an adjusted earnings per share guidance of $1.05 to $1.10, which Reuters said is below analysts’ estimates of $1.70.

The company noted that it continued to experience medical cost trends in excess of those projected in its prior outlook.

“The board believes this is the right time to make a change, and we are confident that David is the right person to lead our company for the benefit of all stakeholders, including customers, employees, patients, and shareholders,” said Roger Farah, newly appointed executive chairman.

“To build on our position of strength, we believe David and his deep understanding of our integrated business can help us more directly address the challenges our industry faces, more rapidly advance the operational improvements our company requires, and fully realize the value we can uniquely create.”

GlobalData MD Neil Saunders said that Lynch, who stepped down in agreement with the company’s board, was not the primary reason for the company’s weak performance.

Saunders added that it is crucial for the company to come up with an integrated plan that includes building a compelling retail proposition.

“Retail remains at the heart of the business and if it is not made to work properly, it puts further stores under threat of closure,” said Saunders.

Earlier this month, CVS Health investor Glenview Capital issued a statement offering suggestions to the pharmacy chain on how to improve governance, culture, efficiency, sustainability and growth.

While noting CVS Health’s “tremendous assets”, Glenview Capital said the company “is operating well below its potential and has fallen short in its investment and actuarial approach in recent years, creating economic losses and volatility that pressures its people, its customers and its shareholders”.

CVS Health decided to pursue a restructuring, which will involve closing 271 additional retail stores and discontinuing the use of certain non-core assets, following a strategic review.