Eyewear retailer Warby Parker’s net loss narrowed as revenue rose in the third quarter of FY23 on the back of 11 new store openings and the launching of four collections.

The company’s net loss decreased 27 per cent year over year to $17.4 million while revenue rose 14.2 per cent to $169.8 million during the three months ended September 30.

Gross margin fell to 54.6 per cent primarily due to the growth of lower gross margin products specifically contact lenses, increased costs associated with optometrists, and higher store occupancy costs.

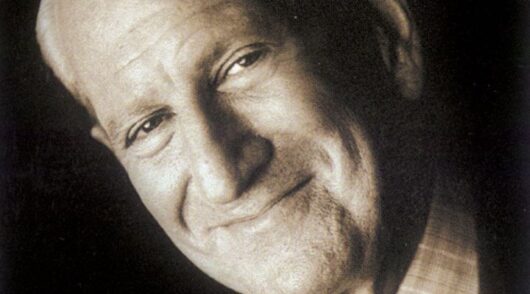

GlobalData MD Neil Saunders explained that people are not keen to purchase new eyewear and such a trend will continue to persist due to current economic conditions.

“As a more fashion-focused player in the market, this hits Warby Parker particularly hard. We do not see this trend disappearing any time soon, so the issue of weak active customer growth is likely to be one that persists.”

Saunders noted that he sees a pathway for profitability for Warby Parker due to the company’s distinct proposition relevant to its customers.

For the first nine months, net loss improved by 51 per cent to $44.2 million as revenue grew 12.5 per cent to $507.9 million.

The company said it is on track to open 40 new stores this year and forecasts annual revenue to grow 11.5 per cent at the midpoint to $666 to $669 million.

“We are confident in our strategic direction and continue to believe we are in the early innings of delivering long-term, profitable growth,” said Warby Parker co-founder and co-CEO Dave Gilboa.