US jewellery retailer Tiffany & Co has reported a 1 per cent drop in worldwide net sales and 2 per cent drop in comparable sales for the two months to December 31.

While Tiffany sales grew strongly in China over the holiday period, softening in other markets that are more dependent on foreign tourist spending led total net sales across Asia Pacific to fall 3 per cent from the prior corresponding period to US$226 million. Comparable sales in the region fell 4 per cent.

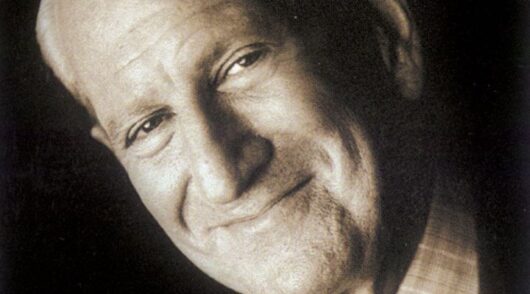

“With continued strong sales growth in mainland China (by a double-digit percentage), solid results in Japan and healthy growth in e-commerce sales, overall holiday sales results came in short of our expectations which had called for modest year-over-year growth,” Tiffany CEO Alessandro Bogliolo said.

“We attribute the difference partly to lower sales to foreign (primarily Chinese) tourists globally, and to softening demand attributed to local customers in the Americas and Europe, which we believe may have been influenced more than expected by external events, uncertainties and market volatilities.”

Total sales across the Americas declined 1 per cent to US$514 million, while Europe dropped 4 per cent to US$132 million.

Japan, however, saw positive growth over the period of 4 per cent – increasing to US$150 million, attributed to higher spending by local customers.

Based on these results, the business now expects worldwide net sales for fiscal 2018 will increase by 6 to 7 per cent compared to the prior year, as opposed to the high-single digits previously expected.

“Now the focus is to grow to new heights,” Bogliolo said. “To this purpose, we will continue to pursue the six key strategic priorities we introduced earlier in 2018 … which will require our ongoing effort and commitment for years to come.

“We acknowledge that external pressures, difficult year-over-year sales comparisons and annualised internal spending are expected to have some negative effects on fiscal 2019 results, mostly in the first half of the year, but we believe Tiffany is on a solid path for improved sales, margins, earnings and cash flow generation over the long term.”

This story first appeared on our sister site Inside Retail Australia.