When Kim Kardashian West (above) announced her new shapewear line, it wasn’t just another new celebrity business venture – it disrupted an entire market.

Within minutes of its launch, Skims (the name Kardashian West settled with after the Kimono backlash) sold $2 million dollars worth of product. When asked how it differed from competition, she emphasised comfort, believing that women should still look like themselves in shapewear.

During the next five years, shapewear is expected to have a compound annual growth rate of 7.7 per cent – a huge indicator of a rising market. Even legacy players like Victoria’s Secret are starting to launch shapewear (in that case through a partnership with Leonisa), and it won’t take long for other retailers to follow suit.

The shapewear boom is being driven by a cultural shift in the female beauty standard: it shouldn’t exist. More than ever, women are embracing body positivity, and perfection is no longer part of the picture. This same belief has seeped into the fashion industry, and for the shapewear market, it is that the garment shouldn’t alter the body type.

“Increasingly, women are no longer dressing for the male gaze,” says Katie Smith, a retail and trends strategist. “Women are finally taking back ownership of their image and identity, and championing the nuances and vast range within feminine experience. This opens up opportunities for shapewear as the narrative shifts to being female-led.”

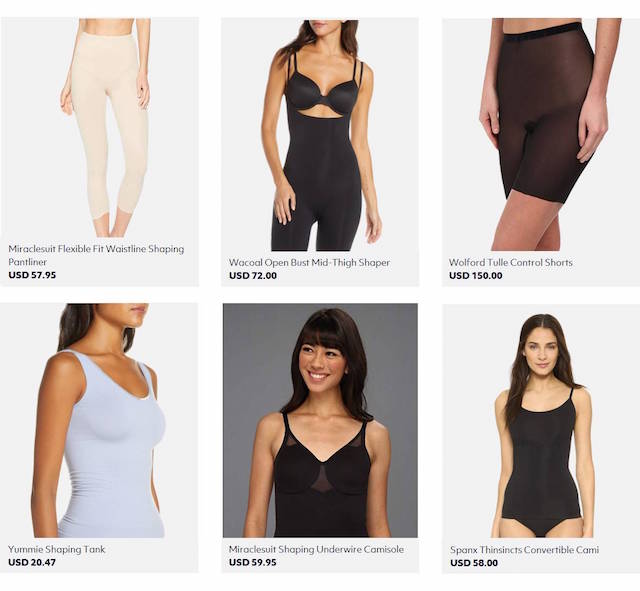

Heist Studios, a newer entrant in shapewear, is focusing on technology to achieve comfort for women. It boasts its engineering-led products are specifically designed for the female body, a rare feat in an industry driven by sex appeal. Competitors like Yummie, Maidenform and Wolford are quickly realising this, as they strongly highlight compression, comfort and confidence in their marketing.

The body positivity shift

However, body positivity extends to size inclusivity and diversity as well – something older competitors are still struggling with. Spanx, the market leader in shapewear that was once championed by Oprah Winfrey, is playing catch-up with its more progressive competitors.

While the brand stressed that its mission has always been to empower women, it’s still lacking in sizes and shades. Skims offers up to XXS-5XL, while Spanx only has XS-3XL. The latter offers multiple colours, yet they’re more suitable for lighter-skinned customers, having only recently expanded into darker browns. For comparison, Heist offers seven nude colours, while Skims offers nine.

According to Omnilytics data, Spanx already lost out to Wolford, Commando and Miraclesuit last year. Both new entrants to the genre and global retailers must take note of this shift to get ahead of the market.

Opportunities and challenges

Omnilytics analysed 900 data points among nine shapewear brands in The Deep Dive: Global Shapewear, uncovering three key insights:

1 How newness doesn’t impact sell-outs

Competitors were highly aware of Skims’ entrance to the market last August, as new-in products increased twofold the following month. However, the number of SKUs was significantly lower than the average for other lingerie categories, such as bras and panties.

Shapewear is evergreen. Unlike trend-driven apparel, the chances of consumers purchasing new shapewear every season are low. In other words, high newness doesn’t guarantee high sell-outs.

According to Omnilytics data, Nancy Ganz and Cosabella both had high new-in rates but underperformed compared to competitors. Miraclesuit, in stark contrast, saw a 91 per cent total sell-out with just 9 per cent new-in rate.

With shapewear, retailers have more reason to get the products right from the bat – which brings us to the next point…

2 Bodies or mid-thighs?

From waist cinchers to full slips, shapewear comes in various styles and silhouettes that enhance certain body parts. As the market is still evolving, there is not as yet a uniform way to categorise shapewear yet – so the key to stocking the right assortment is to identify emerging styles.

In the fourth quarter of last year, more than 70 per cent of the best-selling assortment comprised bodies, panties, mid-thighs and tanks & camis. Bodies and mid-thighs, in particular, had the most interesting trend developments.

Shifts in shapewear

The traditional bodysuit drove 26 per cent of sell-out across all brands, signifying its dominance in the market. Like most innerwear, lace and sheer materials were prominent styles – though turtleneck (for layering) bodysuits were a key style too.

Traditionally, mid-thigh products are meant to sculpt the thigh area. Increasingly, however, most products in the market are now high-waisted – a waist-cincher effect that creates a smoother silhouette.

Bike shorts were a key trend too, made popular in Spring 2019, followed by open-bust mid-thigh bodysuits.

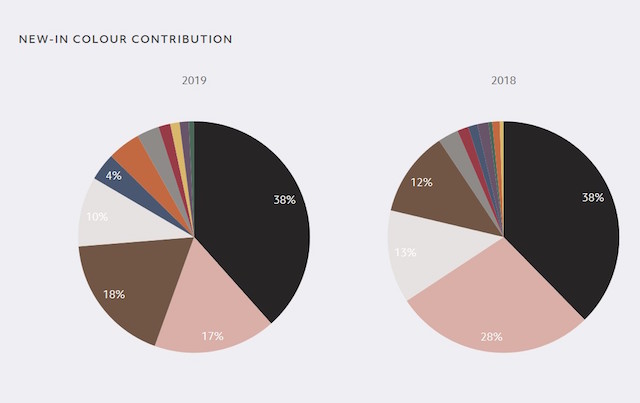

3 The top colours to invest in

The biggest shift in colour is that brown gained 6 per cent – and all in the name of diversity. That said, while strides were made to champion darker-skinned consumers, it isn’t as prominent as the colour pink, which saw a surge of 11 per cent.

To stay ahead, it is crucial for retailers to drive the inclusivity movement and, more importantly, not treat it as an afterthought. Shapewear, after all, appeals to women of all shapes and sizes, and it is a large consumer group to tap into.

Fashion colours, too, rose from 10 per cent of the assortment in 2018 to 17 per cent last year. Brands like Commando and Yummie were the pioneers here, having adopted more fashion colours. Blue and orange took up half of the new-in contribution, taking a cue from New York Fashion Week Autumn/Winter 2019.

Key takeaways

For retailers looking to expand into this category, here are three main takeaways:

Keep inclusivity at the forefront: All facets of fashion have to face today’s reality: consumers are walking away from idealised perfection. They prefer realities, and increasingly, that means fashion’s narrow framing of beauty has to change. Inspired by the broader social movement that is #MeToo and Generation Z’s driving force in activism, brands are quickly realising that to remain relevant, they must innovate. Brands that challenge the status quo by increasing inclusion have the upper-hand – Skims and Heist Studios are prime examples. Other shapewear brands are forced to play catch-up. For new entrants in the market, thinking about the female body in all its forms – by race, size and disability – is a good start. Adopting a one-size-fits-all approach will only further alienate consumers.

High newness doesn’t guarantee high sell out: Due to shapewear’s evergreen nature, getting the right products with the right style is crucial. Stocking a high amount of newness, without first understanding market demands, leads to costly overstocking issues.

Recognise key styles: To perfect a shapewear assortment, brands and retailers need to look to pioneer brands – understand assortment mix, designs, colours, price ladders – to gauge bestselling styles. Taking a look at trends in other categories (such as cycling shorts from athleisure) helps too, as that offers a broader understanding of how trending silhouettes impact shapewear.

- Phung Yi Jun is the lead content editor at Omnilytics, a data platform powering business decision making with deep and actionable insights. Jun built her career as an independent fashion writer and covering news and trends in retail before transitioning to her current position at Omnilytics.